© 2020 Thrive, LLC.

© 2020 Thrive, LLC.

Silver Lion Student Loan Advisors

Specializing in helping those employees with Federal Student Loans reduce their monthly payment and seek Loan Forgiveness

About Silver Lion

Silver Lion Student Loan Advisors help individuals with Federal Student Loan Debt. The numbers are staggering and the debt keeps climbing. The U.S. Department of Education offers programs to lower payments and forgive loans but those programs are hard to understand, enroll into, and remain compliant.

Here are the Facts:

Silver Lion Student Loan Advisors has ONE goal. We work tirelessly to help individuals who are struggling with their Federal Student Loan student debt to enroll in a government sponsored program to reduce their monthly payment. If we are successful in providing this service, our clients can start saving for retirement, building equity to purchase a home, and afford day-to-day living expenses without incurring additional debt.

Our mission is to assist consumers with federal student loan consolidation document preparation. A Direct Consolidation Loan allows you to consolidate (combine) multiple federal education loans into one loan. The result is a single monthly payment instead of multiple payments. Loan consolidation can also give you access to additional loan repayment plans and forgiveness programs. We will help you find the best repayment options that may be available for your current financial needs. We will be with you every step of the way.

How The Program Works

Consolidate.

Enroll.

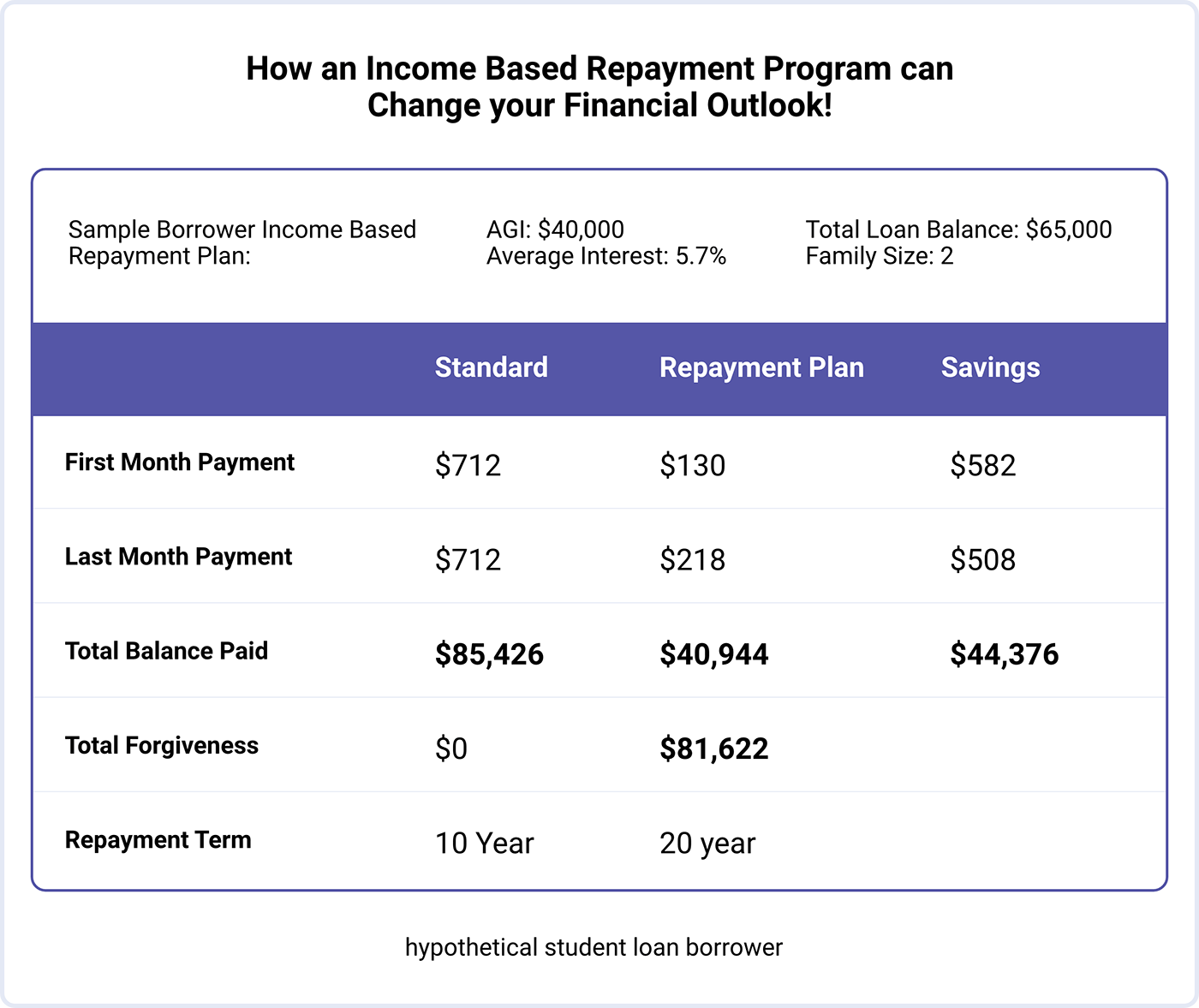

An income-driven repayment plan sets monthly student loan payments at an amount that is intended to be affordable based on income & family size.

Recertify.

An income-driven repayment plan sets monthly student loan payments at an amount that is intended to be affordable based on income & family size.

**If a borrower needs a lower payment before their recertification is due — i.e. they lose their job, furloughed, or had a baby — they can re-certify their income-based repayment early and ask for an immediate payment adjustment.

Forgive.

Borrowers often qualify for loan forgiveness, cancellation, or discharge of the full amount of their loan and are no longer obligated to make loan payments.

Our goal is to help every borrower, whether its to enroll them into an income based program, get them out of garnishment, or simply assure them that they are already in the best program for their circumstances.

How we can help:

CONTACT US

PROCESS

EVERY STEP OF THE WAY

We consolidate your loans, enroll your loans into an IBR program, and take all of the processing & documentation off your plate.

Want to stay up-to-date with Thrive news?

Sign up for our news letter today!